A proper valuation takes into account the specific circumstances of the company and the current and future developments that can affect the value of the enterprise.

In a positive as well as in a negative sense.

A decent valuation is based on the following elements:

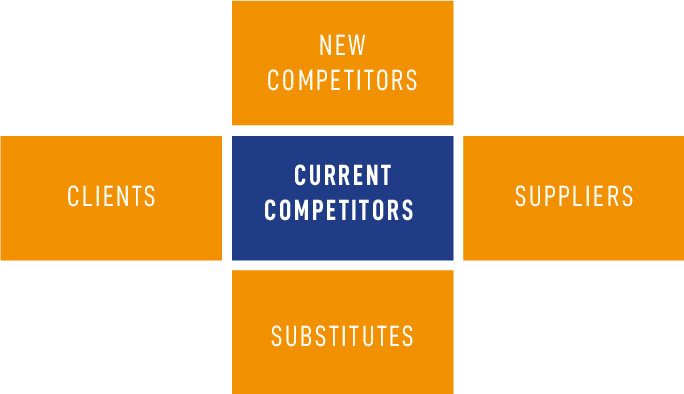

Michael Porter’s five forces model

Historic results can be an indication for valuation, but…

Past results are not guaranteed in the future!

If a valuation is based on averages in the sector or on similar companies, the question is:

© 2024