Willem Smeets advises on

- Business valuation

- Financial disputes

- Economic damages

- Business succession

Business valuation is more than just a calculation

Business valuation is a profession and asks for a professional approach.

Previous slide

Next slide

When?

Willem Smeets advises on:

- Business succession

- Financial disputes

- Economic damages

- Other valuation issues

Who?

Willem Smeets acts as an advisor for all those involved and advises:

Valuation methods

For business valuations, the following methods can be applied:

Business valuation

A proper valuation takes into account the specific circumstances of the company and the current and future developments that can affect the value of the enterprise.

In a positive as well as in a negative sense.

A decent valuation is based on the following elements:

- Money (cash flows): how much do I invest now and what will I get in return later

- Time: when do I receive the proceeds of my investment

- Risk: what return is required, considering the risks of the investment

Business valuation is more than just a calculation

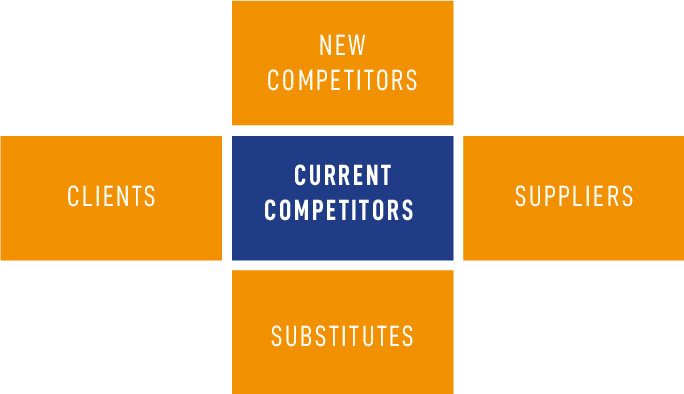

Michael Porter’s five forces model